This is a valuable article worth $2000, written by an expert with 12 years of export experience in China. It provides practical guidance on how to import products from China to your country, step-by-step. You will learn:

- How to find the right products?

- How to calculate import tariffs?

- How to find reliable suppliers?

- How to find reliable logistics?

- What documents are required for import?

If you are interested, please continue reading below.

Contents

Contents

Step 1

Select The Right Product

Every startup must start with a product. We have visited many experts and have finally come up with 5 steps to researching a product to help you pick the right one and bring it to market. If you already have a selected product, please skip this step

#1 Define your research objectives

This is one of the most important aspects, defining a clear objective. We often say the phrase: don’t talk to me about efficiency if you don’t have a goal.

#2 Narrow down your research

Every product has many dimensions, which metrics are you actually researching? We can break down the product in three dimensions: macro, meso and micro. Here is a diagram of the research framework.

|

Level |

Objective of analysis |

The framework of the analysis |

The products you wish to sell |

|

macro |

Analyze an industry |

1. Analyze industry dynamics and gain industry insight |

|

|

meso |

Analyze a company |

1. Analyze the company structure |

|

|

micro |

Analyze a company product |

Analyze the company’s operating data, the logic behind the product is selling well |

|

The more clear the research goal is, the more efficient the research effect is. These models, if the small models can meet your needs, don’t choose the big ones.

# 3 Make a list of competing products

What are so many products on the market worth studying?

We summed up 3 types of projects that you try to study thoroughly, including direct competition, concise competition, and reference.

Direct competing products are products with the same model and the same needs.

Indirect competing products are different from your model, but they solve the same problem.

Reference products, strictly speaking, it is not called competing products, they may be very similar to your model, but not with you to grab the cake, the research of this kind of products, can help you avoid detours.

# 4 Get intelligence by any means

If 99% of the information can’t be easily obtained through google and YouTube, so how do you get this deep information?

The 12 strategies are as follows:

Full experience products

Reverse data analysis

Interview users directly

Collect product word of mouth

Partner research

Collect inside information

Make good use of job tools

Pretend identity interviews

Company public information

Visit industry experts

Third party database

Industry research report

# 5 Get the information and judge it correctly

After getting the information, can you make a high-quality business judgment?

The core is small steps and fast run, fast trial and error, continuous testing, and finally fast run through the business model. For this entrepreneurial methodology, please refer to Eric Ries‘s book <The lean startup>(http://theleanstartup.com/)

Step 2

Import Tariffs & value-added taxes Calculate

Most products are subject to import taxes (often called tariffs or duty) and value-added taxes . Some countries have very high duties and taxes, and others relatively low duties and taxes.

Here’s a step-by-step guide to finding out your country’s tariffs:

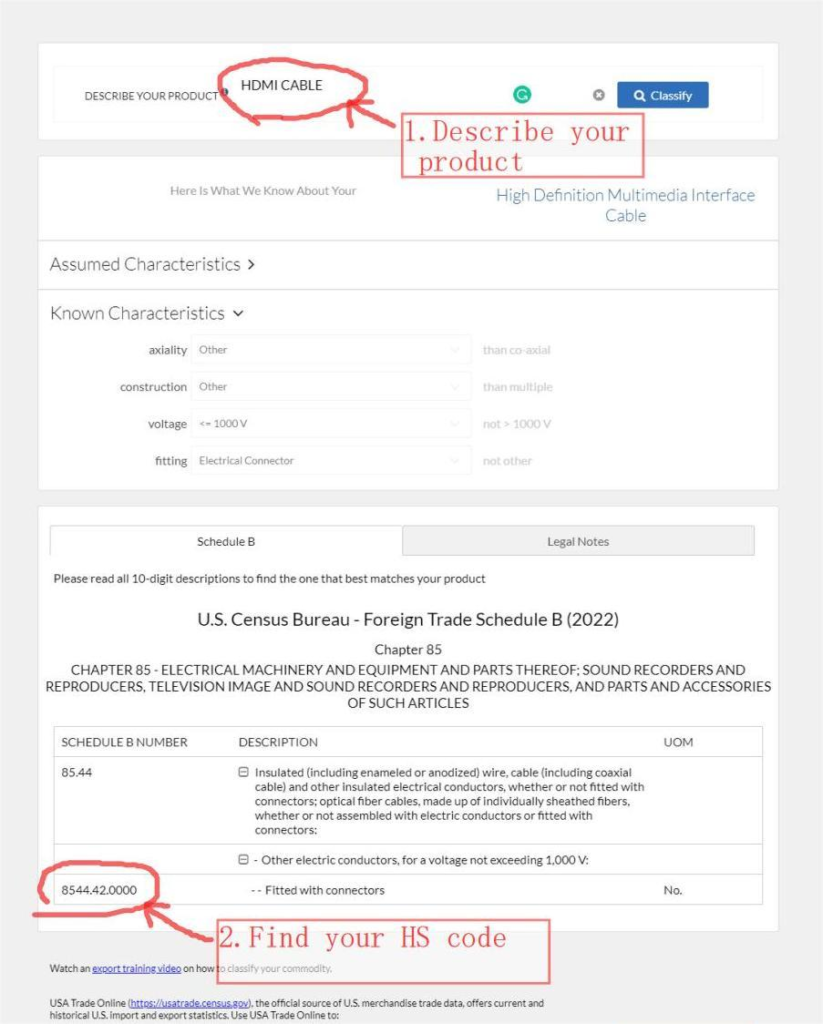

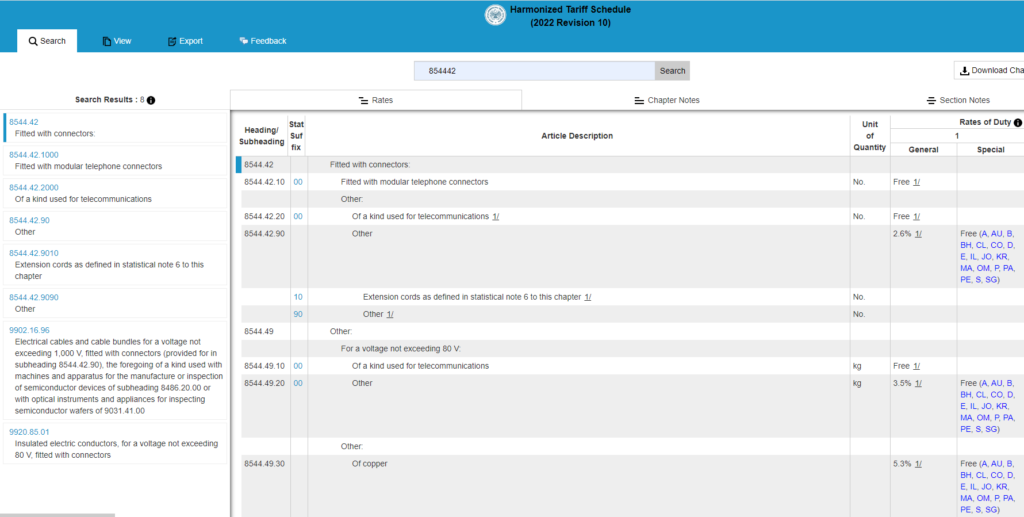

Setp #1 Identify the HS Code

The first step in determining duty rates (also referred to as tariffs) is to identify the HS Code. You can use the following link to query the HS code. https://uscensus.prod.3ceonline.com/

For example, if you are looking for the HS CODE of HDMI Cable, you can find the HS CODE 854442 as shown in the picture below

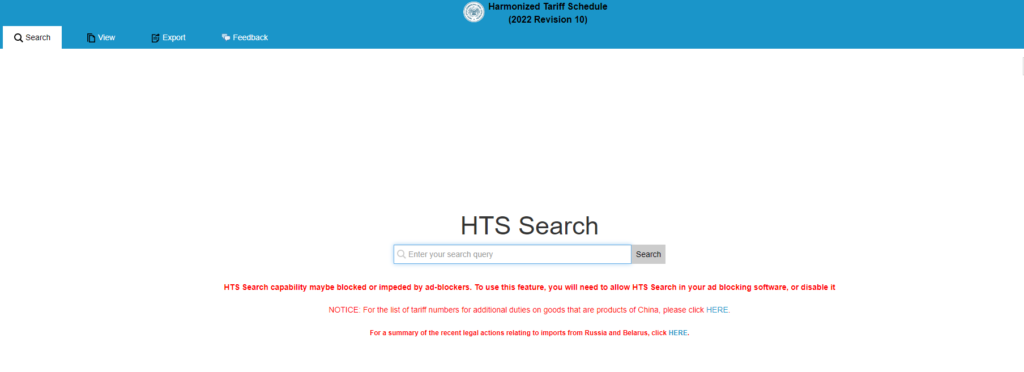

Step #2 Finding Your Tariff Rate

Once you know the classification number or an HS (harmonized) code for the product you are exporting, look up the corresponding tariff (duty) rate by consulting the tariff resources listed below.

The US Customs import tariff website: https://hts.usitc.gov/

Still using HDMI cable as an example, after entering the HS CODE, you can find out that the import duty required is 0%. However, it is important to note that HDMI cable falls under the category of ADDITIONAL DUTY and is therefore subject to a 25% additional duty.

The EU Customs import tariff website: European Union Tariffs (TARIC)https://taxation-customs.ec.europa.eu/business/calculation-customs-duties/customs-tariff/eu-customs-tariff-taric_en

The South Africa import tariff website: South Africa Customs Union (SACU)https://www.sacu.int/show.php?id=420

The WTO WTO Tariff Database Webstie: https://www.wto.org/english/tratop_e/tariffs_e/tariff_data_e.htm

The AU customs import tariff website: https://business.gov.au/products-and-services/importing/importing-and-your-business#:~:text=All%20imports%20are%20subject%20to,by%20the%20Australian%20Taxation%20Office

Import duties for any country can be found on the local government website by using google and searching for “your country + import duty“.

Step #3: Finding Your Country value-added taxes

You can use google to search for VAT in any country, as shown below for VAT in Australia, you can learn that the tax rate is generally 10%

Bottle line

When selecting products to purchase, make sure that you look up the HS classification of each product to calculate its applicable tariff and ensure that its profit is still worthwhile.

Step 3

Find Reliable Supplier

Finding a trade partner to supply the things you’re sourcing is important.

Where to Source Chinese Suppliers

Alibaba

Alibaba is the most prominent directory of suppliers and products for importers and dropshippers alike.

Unfortunately, a significant amount of fraud and cons occur on these websites. There is no screening mechanism, and many of the suppliers are superfluous middlemen. Many high-quality vendors choose not to list their products on Alibaba and can only be found elsewhere.

Consequently, these sites are the ideal places to get started with access to global suppliers, and they include conveniences to make the process easier for newcomers. As a new importer, they are therefore worthy of consideration.

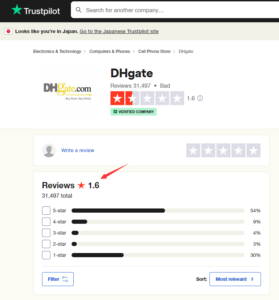

DHgate

DHgate is a lot like AliExpress in that it is more of a wholesale market than a list of suppliers. This means that it is focused on products, which makes it a good choice for people who are just starting out or who only import occasionally.

The platform is known for having goods at reasonable prices, but buyers often say the quality isn’t what they expected. Most of the time, the minimum order quantity (MOQ) for products on DHgate is quite low.

One of the best things about DHgate is that its payment system keeps money safe until the buyer confirms that they have received the goods.

Canton Fair

This is the biggest trade show in the country. It is also called the China Import and Export Fair. There are usually between 20,000 and 60,000 vendors, and many people think it’s the most important trade show in the world.

The Canton Fair takes place twice a year in Guangzhou, China, and has three parts: electronics, consumer goods, gifts, and home decor, and textiles, clothing, shoes, and office supplies.

Manufacturers and trading companies from all over China and the rest of Asia bring their goods to the event. This makes sure you can find the products you want or find someone who can make them.

Most of the suppliers at the Canton Fair have exported to buyers in the United States and Europe before, so they have the infrastructure and know-how to make shipping easy.

Global Sources Trade Show

In Hong Kong, this event happens twice a year. It is planned to happen right before the Canton Fair, which makes it easy for people to go to both shows on the same trip to China.

The Global Sources Trade Show is much smaller than the Canton Fair, but it has more suppliers in some key areas, such as electronics and clothing.

During the event, it also offers a variety of educational services, such as a conference on how to run a successful importing business. At the conference, big names in ecommerce business from all over the world come to talk and learn.

Yiwu Wholesale Marketplace

If you don’t mind going to China, the Yiwu Wholesale Market is another way to find products and suppliers in real time. This exchange is open every day of the year, unlike China’s well-known trade shows (except for national holidays).

The city of Yiwu itself is called China Commodity City. It is in East China, about 200 miles south of Shanghai, and is a hub for trading consumer goods. In addition to the main market, there are several other markets around the city that focus on different kinds of goods.

Most of the people selling things in the market are trading companies that work closely with factories in the provinces next to them. You can work with them to set up shipping and reorders, or you can hire a local agent (who also aids in negotiation and purchase agreements).

Most of the things sold in Yiwu are very cheap and have a bad reputation for being low quality. Many products don’t have any kind of branding at all, and most of the ones that do are fake.

This makes Yiwu a popular place for retailers to look for impulse buys and other small items to sell in their stores. You can cross-sell these products or offer “free gift” promotions with them.

Shenzhen Huaqiangbei Electronic World

Huaqiangbei is a business street in Shenzhen where there are many wholesale markets with a lot of electronics, especially mobile phones. It has formed a strategic partnership alliance with more than 20,000 brand manufacturers, distributors and retailers in the industry.

When copycat or knockoff mobile phones were popular, a lot of unbranded phones were sent out from here. Even though merchants here no longer sell mobile phones, the other electronics are still very popular. If you work in an industry that has anything to do with electronics and you’re in Shenzhen, you have to go to Huaqiangbei.

Huaqiangbei Market sells all sorts of electronic goods. The types of goods sold on each floor vary. There is also a navigation plate outside the gate that tells you how to find the right product category so you can easily find what you need.

China Sourcing Agent

If you already work with a reliable Chinese sourcing agent but seek another product they don’t supply, try using them as a resource. It’s standard for suppliers to have tight networks and happily refer clients (they often make a 5%–10% fee).

What is the difference between a trading company, a sourcing agent and a factory?

Factories, Trade companies, and Sourcing agents are the Chinese suppliers you’ll run into.

There are two methods you can use to find suppliers and items when importing from China. The first is operating alone or importing directly from the factories and trade companies in China. The second is to work with sourcing agents.

Trading companies

doesn’t make most of the goods it sells. Instead, it buys goods from one or more factories and keeps them in stock.

Their best qualities are:

Quality control at a higher level

Lots of different products

Reduce the minimum order size (MOQs)

The best place to find a wide range of products

Most of the time, customer service and sales support are strong.

Their bad points are:

Costs went up

Less power over design, materials, and production for the buyer.

Factory

mostly makes products from raw materials.

Their best qualities are:

Price drops

The buyer has more say over the design, materials, and making of the product.

Best for finding products made to order

Their bad points are:

fewer things to choose from

Minimum order sizes that are higher (MOQs)

The language barrier

Miscommunication

Sourcing agents

It’s not easy to work directly with Chinese suppliers. Most importers depend on a sourcing agent in China for help and support.

Their best qualities are:

Huge network of suppliers in China

Transparent with clients

Reduce the time cost of finding suppliers

Find the right supplier based entirely on the customer’s requirements

Their bad points are:

Unfamiliarity with specific product supply chains

Additional service charges

Bottle line

Whatever your Chinese supplier’s business strategy, the procedure for importing goods from them will be quite identical aside from those specifics. Therefore, if the offer is good, don’t focus too much on the supplier is a factory or trade business.

Step 4

Logistics

Airfreight may be viable only if the quantities are small and the commodities are tiny in size and weight. The overall transportation cost by sea is determined by the container size, which affects the landing unit price of the commodity.

There are different types and sizes of sea containers for import from China:

20GP: maximum capacity of 28 m3*

40GP: maximum capacity of 58 m3*

40HQ ou HC: maximum capacity of 66 m3*

*Actual number of cubic metres available

You can hire a freight forwarder to take care of the logistics of transporting your goods. If you don’t have a freight forwarder, you can also ask your china sourcing agent to help recommend a trusted freight forwarder to you

Step 5

Documents for import from China

Importers are frequently perplexed about customs clearance after determining which products to import from China and locating the proper manufacturer through a sourcing agent.

When your shipment arrives in the country, you will need to obtain the following papers from your China exporter .

Perhaps you may ask: i want to import products from china. Please advise me about the documents required.

The following list will be your ultimate solution.

Commercial invoice

The commercial invoice is the most important document in any company transaction. One of the documents necessary for import customs clearance is an invoice for value appraisal by the relevant customs official.

It is also a formal note for payment.

To know more about the commercial invoice, read here.

Packing List

A packing list is an itemized list that includes information on the goods. It aids in their evaluation and correct counting during clearance.

To know more about the packing list, read here.

Bill of Lading (B/L)

This is the most significant document in the shipping procedure. A bill of lading for a sea shipment is a carrier’s document that must be submitted to customs for import customs clearance. The bill of lading or airway bill issued by the carrier contains the specifics of the goods as well as the terms of delivery.

To know more about the bill of lading, read here.

Air Waybill (AWB)

An air waybill (AWB) or air consignment note is a receipt issued by an international airline for goods and an evidence of the contract of carriage. It is not a document of title to the goods. The air waybill is non-negotiable.

To know more about the air waybill, read here.

Proforma invoice

A proforma invoice is a document that shows the seller’s commitment to sell items to the buyer at predetermined prices and terms.

To know more about the proforma invoice, read here.

Certificate of Origin

A Certificate of Origin or Declaration of Origin (sometimes abbreviated to C/O, CO, or DOO) is a document commonly used in international commercial transactions that attests that the goods stated on the document has met certain criteria to be considered as originating in a specific country. A certificate of origin / declaration of origin is typically prepared and finalized by the exporter or manufacturer, and it may be subject to official validation by a third party. It is frequently submitted to the importing country’s customs authority to justify the product’s eligibility for entrance and/or claim to preferential treatment. The International Chamber of Commerce publishes guidelines for the issuance of Certificates of Origin by chambers of commerce around the world.

To know more about the Certificate of Origin, read here.

Export Customs Declaration Information

A customs declaration is a form that lists the details of goods that are being imported or exported when a citizen or visitor enters a customs territory (country’s borders).

To know more about the Certificate of Origin, read here.

If you have a sourcing agent in China, these documents can be easily completed with the assistance of a sourcing agent. Click here to contact sourcing agent.

Step 6

Obtain your shipment

The destination agent designated on the B/L will normally notify the consignee via an arrival notification within 5 days or fewer of port arrival.

When a shipment arrives in the United States, the importer of record (the owner, purchaser, or licensed customs broker designated by the owner, purchaser, or consignee) will file entry documentation with the port director at the port of entry for the goods.

Documents required for entry are:

- Commercial invoice.

- Bill of lading.

- Air waybill.

- Certificate of origin.

- Export and import licence.

- Export packing list.

- Insurance certificate.

- Inspection certificate.

For more details please see here

The End

Thank you for reading. If this article has been helpful to you, please feel free to share it with others. If you have any questions about the methods of importing Chinese products mentioned in this post, or if you have better ways to find Chinese suppliers, please leave a comment below or email me directly at jack@moofsourcing.com.

We are a leading procurement company based in Shenzhen, China, committed to helping buyers find the best Chinese suppliers at the most competitive prices. If you are interested in importing products from China or visiting China, please do not hesitate to contact us.